Retiring Early

Retiring Early: Challenges and Opportunities in a Changing Landscape

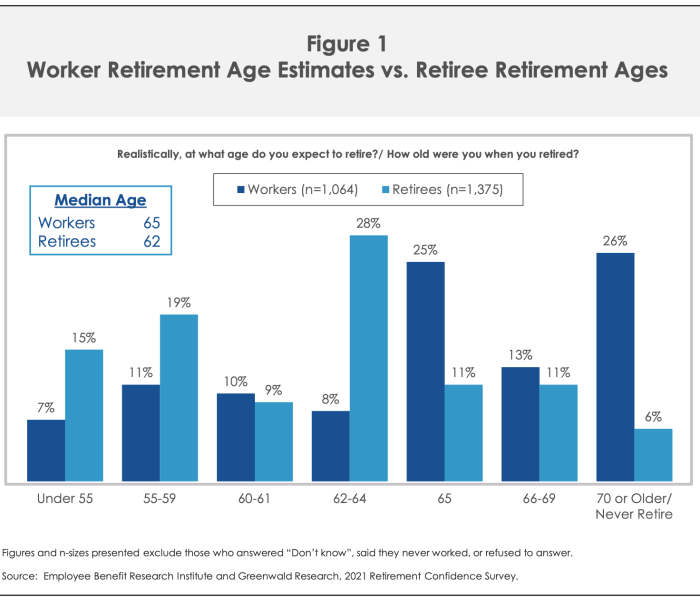

The desire to retire early is a common goal for many Americans, but the cost of retirement can make this a challenging goal to achieve. According to a recent study by the Employee Benefit Research Institute, only 34% of Americans retire before the age of 60, and nearly a third retire after the age of 65. This is due, in part, to the increasing cost of retirement. Furthermore, the average life expectancy in the US has increased significantly over the past few decades. This means that individuals need to plan for a longer retirement period, which results in the need for additional savings to support an extended retirement period.

In the meantime, healthcare costs are a significant factor contributing to the rising cost of retirement. According to a study by Fidelity Investments, the average 65-year-old couple retiring in 2022 can expect to spend $315,000 on healthcare costs throughout their retirement. This can put a significant strain on retirement savings, making it harder for individuals to retire early.

Retirement income sources such as social security and pensions have become less reliable in recent years. According to the Social Security Administration, the average monthly social security benefit in 2021 was $1,696, which may not be sufficient to cover all of an individual’s retirement expenses. Additionally, many employers have moved away from traditional pension plans, leaving individuals responsible for funding a larger portion of their retirement income through personal savings or investments.

Finally, many individuals may not have a clear understanding of their future retirement needs and expenses. For example, they may not know how much they would need to maintain their current lifestyles in retirement or may underestimate the impact of unexpected expenses, such as home repairs, medical emergencies, or travel expenses. These costs can quickly deplete retirement savings, leaving individuals struggling to meet their basic financial needs. Additionally, they may not be aware of the impact of inflation on their retirement expenses, or how taxation diminishes their income streams, both of which could put a strain on the cost of living over time.

Despite these challenges, working with a financial planner can help bridge the gap between the desire to retire early and the increasing cost of retirement. A financial planner can help individuals create a personalized plan that takes into account their unique circumstances, goals, and risk tolerance. They can help identify potential gaps in savings, suggest appropriate investment strategies, as well as identify missed opportunities in tax savings. In addition to managing risk, a financial planner can help clients balance their long-term goals with their short-term needs. For example, a client may need to save for both retirement and a child’s college education. A well constructed plan can help the client balance these competing priorities and ensure that they are on track to meet their goals. By creating a personalized retirement plan, managing investments, and empowering the client to react to changes in their personal situation, as well as pivot in the face of legislative changes, a financial planner can help individuals achieve their retirement goals, regardless of the hurdles they face.

Employee Benefit Research Institute (EBRI) – “Retirement Age Expectations of Americans: A 2021 Update”: https://www.ebri.org/docs/default-source/rcs/2021-rcs/rcs_21-fs-2.pdf?sfvrsn=2d83a2f_4

Fidelity Investments – “Planning for Health Care Costs in Retirement”: https://institutional.fidelity.com/app/item/RD_13569_42402/retirement-planning-health-care-costs.html

Social Security Administration (SSA) – “Monthly Social Security and Supplemental Security Income (SSI) Benefits”: https://www.ssa.gov/policy/docs/quickfacts/stat_snapshot/

Disclaimer: Investing in financial markets carries risk, including loss of principal. You can lose some or all of the money that is invested. Past performance is no guarantee of future results. The material contained herein is for informational purposes only. This document does not constitute a recommendation of securities, securities portfolio, transactions or investment strategies. The projections were created based on hypothetical information, there is no guarantee that any of them will come true. Proxy Financial is a registered investment adviser. Proxy and its Financial Advisors are not licensed in all states to offer securities and insurance products. This site is not a solicitation of interest in any of these products or service in any state which the registered representative is not properly licenses.